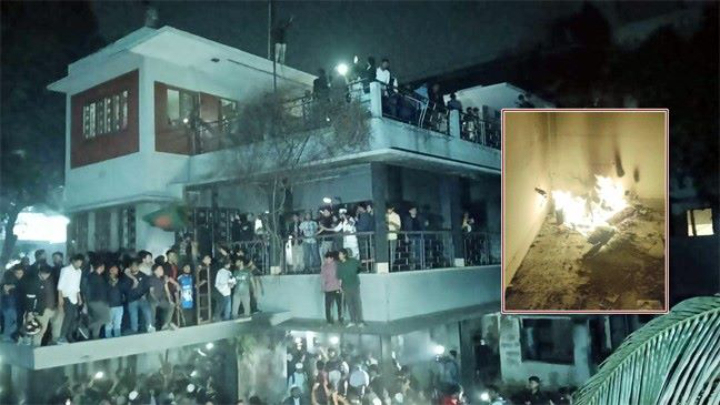

Is Bangladesh progressing in the same way as Sri Lanka?

Is Bangladesh going to face economic bankruptcy like Sri Lanka?

By applying common sense, we will see today that Bangladesh is progressing in the way of Sri Lanka, or is it all a rumor or propaganda!

The most talked about reason behind Sri Lanka's current state is Chinese debt.

The world's perception of China's debt is that they lend indiscriminately. China does not see whether the borrower can repay the loan. For example, China has built a deep sea port at Hambantota in Sri Lanka. But this port has not calculated whether it will be able to repay the loan.

It is said that China has given loans to Sri Lanka without knowing that it will not be able to repay the debt because the port can be written off later. However, this is the case. And it is this issue that the anti-China bloc, including the United States, has taken the term "Chinese debt trap" to the level of branding.

On the other hand, the loan conditions for IMAs are very strict. The IMF ensures that he will get his loan back. If necessary, changes in state policies are also made. IMF loans not only provide money, but also build trust and confidence. This is why Sri Lanka is currently desperate for an IMA loan.

Also mentioned is another thing. In Islam there is a term Barakat. Being blessed with income. Chinese debt is not blessed. Sri Lanka can get China's loan if it wants, but the economy will not recover with it. Because there is no blessing in Chinese loans. But IMF or World Bank loans are blessed.

The blessing or greatest currency in trade or exchange is trust. When faith rises, it is called blessing.

Therefore, even if Sri Lanka does not regain credibility in the international market with China's money, Sri Lanka will regain that trust with IMF money.

In April of this year, Sri Lanka received a loan from the IMF for $4 billion. IMF says it will take 6 months to disburse loans to Sri Lanka.

All stake holders will regain confidence in Sri Lanka if they get this loan.

At that time, Sri Lanka sought loans from various countries of the world to pass the time until getting a loan from the IMF. India gives an aid of about one and a half billion dollars. World Bank gives 600 million dollars.

Sri Lanka gets half of the loans it seeks from the IMF as business loans. Many have started saying that Sri Lanka should have gone to the IMF earlier. Sri Lanka made a mistake by not going ahead.

Now the question is whether the IMF will give a loan to Sri Lanka? The answer is yes.

Basically, the IMF follows America's wisdom. And America wants Sri Lanka to withdraw from China.

Let's come now, how much is the collaboration between Sri Lanka and Bangladesh? Is Bangladesh going to be the next Sri Lanka? Will Bangladesh become bankrupt like Sri Lanka in the trap of Chinese debt?

Let's see what international media reports and analysis of different economic sectors of Bangladesh say.

Bangladesh has not borrowed as hastily and imprudently as Sri Lanka in terms of state income, foreign exchange reserves, unnecessary debt, borrowing from multiple sources. For example, China wanted several other projects besides Pigeon Power. One of these is the Pira deep sea port, which Bangladesh disagreed with as the maintenance cost of dredging was not realistic.

Similarly, China came up with a proposal to build a smart city on the model of Shanghai in Chittagong, but Bangladesh did not agree to give China any more space in the maritime border. But Sri Lanka did the opposite. They have borrowed billions of dollars in unimportant non-profit projects but have not been able to repay them.

In the financial year 2019-20, Bangladesh borrowed 38 percent from World Bank, 34.7 percent from IMF, 24.5 percent from ADB, 17 percent from JICA and only 6.81 percent from China. So the repeated talk that Bangladesh will fall into the debt trap of China is not correct. Because Bangladesh is not dependent on Chinese loans. Bangladesh borrows from many sources.

On the other hand, none of the mega projects undertaken by Bangladesh are unnecessary; Everything is important and only the income that comes from it can repay the loan. If these projects are implemented, returns come immediately. Investment and GDP growth in the country.

According to IMF, a country is at risk of bankruptcy if more than 55 percent of its economy is in debt. Bangladesh's debt ratio is now 38 percent of GDP. On the other hand, Sri Lanka's debt ratio is 119 percent of the country's GDP. Bangladesh's per capita debt amount is 292.11 dollars whereas Sri Lanka's per capita debt amount is 1650 dollars.

The most important thing is that Bangladesh has added its own money with loans from other development agencies including World Bank, ADB, IDB, JICA in all small and big projects and the interest rates of these agencies are also very low. Payback time is also longer.

On the other hand, Sri Lanka has implemented major projects with suppliers' credit loans from China. They did many unnecessary projects which did not work. The interest rate of these projects is also very high. Sri Lanka is now in danger of actually repaying those loans with interest.

On the other hand, Bangladesh is the world's third largest exporter of ready-made garments, the eighth largest country in the world in terms of remittance income, from which it can easily pay the interest on the loan and Sri Lanka is dependent only on local income. Loan interest has to be paid from this income. But the country is not able to repay the debt due to the stoppage of local income. The debt burden of the country is increasing.

Bangladesh has not defaulted or failed to repay any debt so far. And there is no risk of failure in the future with what Bangladesh earns. And this is why the IMF this time too